Building wealth

beyond borders

Discover a holistic approach to grow your wealth and safeguard against devaluation with personalized financial planning tools and US real estate investments

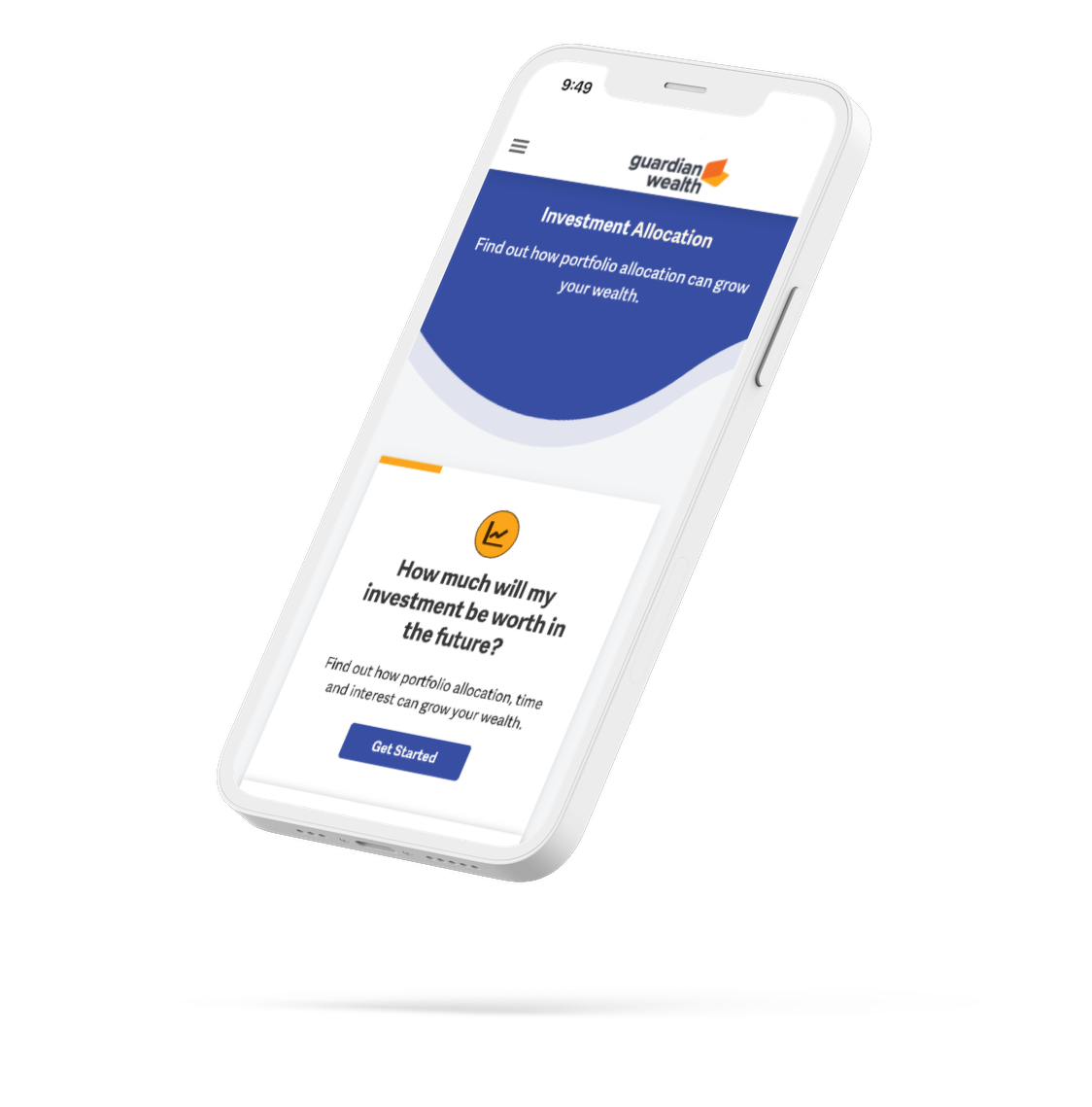

Built by financial experts, our AI-powered platform empowers you to take control of your financial future.

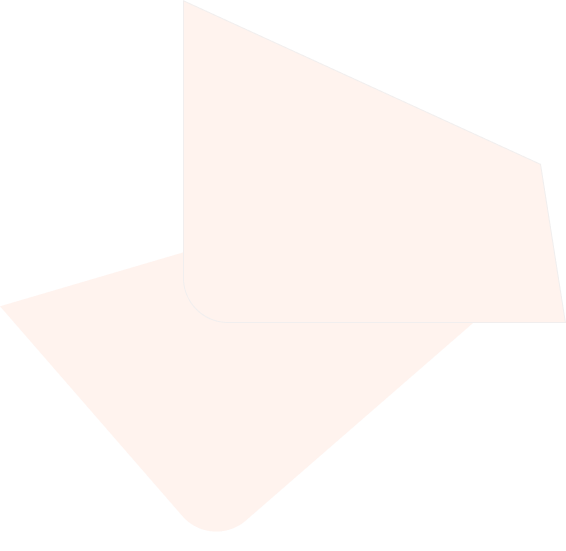

Start with a financial health checkup — in less than 5 minutes — get your personalized recommendations with tools, content, and courses that are right for you.

We make direct ownership in US real estate accessible and transparent. With a stable market, attractive rental yields, and a history of long-term appreciation, the U.S. offers a solid foundation for your investment portfolio.

Our expert team will be your trusted guide every step of the way from buying to property management, and even selling when the time is right. Discover the potential of US real estate to build wealth.

The path to wealth creation can be fraught with challenges. You don’t have to go it alone. Invite friends, make new friends and be empowered. Be part of a community of Wealthbuilders.

As we navigate the digital age, the landscape of personal finance is undergoing a profound transformation. No longer are we...

Read MoreObtaining a conventional mortgage can be a complex and time-consuming process, often involving a mountain of paperwork. The documentation typically...

Read MoreAcross the spectrum of investment avenues, real estate stands out as a consistent, tangible, and historically rewarding asset class. It’s...

Read More